15

2025

-

01

Start of 2025: Where is the energy storage reshuffle progressing to?

Author:

At the beginning of 2025, the candidates for the centralized procurement of energy storage for the 2025-2026 fiscal year by China Nuclear Huineng and Xinhua Power Generation are announced: seven companies have been shortlisted, including Sungrow Power Supply, Haibosichuang, Chuneng New Energy, Tiancheng Tongchuang, Wanbang Digital Energy, Xuchang XJ Electric Science and Technology, and Ruipu Lanjun.

In 2025, the announcement of the candidates for the centralized procurement of energy storage by China Nuclear Energy and Xinhua Power Generation for the 2025-2026 fiscal year:Seven companies, including Sungrow Power Supply, Haibosi Chuang, Chuang Energy New Energy, Tiancheng Tongchuang, Wanbang Digital Energy, Xuchang XJ Electric Science and Technology, and Ruipu Lanjun, have been shortlisted.

The total capacity for this energy storage system procurement is 12GWh, including 2h (0.5C rate) and 4h (0.25C rate) solutions, without distinguishing between air cooling/liquid cooling, suitable for shared/supporting energy storage. The centralized procurement framework is valid until May 31, 2026.

According to previous bidding records, a total of 65 companies participated in the bidding, with a price range of 0.42 to 0.53 yuan/Wh, and an average bid of 0.466 yuan/Wh. The bid range for the shortlisted companies is 0.44-0.51 yuan/Wh, with an average shortlisted price of 0.4757 yuan/Wh.

Price competition is still playing out in the energy storage field, and a reshuffle is underway.

On one hand, in the domestic large-scale energy storage equipment bidding market, it tests the general strength of energy storage equipment suppliers,The winning companies have shown a certain degree of concentration, and the space for large-scale orders for new entrants has narrowed.

On the other hand,the range of companies obtaining orders overseas is also gradually narrowing, mostly consisting of companies or groups that have accumulated experience from previous overseas ventures, where overseas experience has become an important advantage.Since the second half of 2024, multiple super large orders have appeared in the overseas market, most of which have been obtained by top companies, and the Matthew effect in the energy storage field is becoming increasingly pronounced.

The first wave of reshuffling is underway.

Various signs indicate that the energy storage industry is undergoing its first wave of reshuffling. Although many energy storage integrators and battery companies have exited in 2024, the imbalance between supply and demand still structurally exists.

The core reason still lies in the imperfect energy storage revenue model, which is mostly used as strong matching energy storage for wind and solar. Industry comments suggest that current energy storage is a sunk asset, and its true value has yet to be revealed.

GGII indicates that the CR10 for integrators and energy storage batteries in 2024 will be 82% and 94%, respectively, and it is expected that the concentration of integrators will rise to over 85% in 2025.

Looking at the three channels of energy storage revenue, such as electricity market trading, capacity leasing, and policy subsidies, none can support the revenue of energy storage projects. Liu Qing, chief expert at the National Power Planning and Design Institute, pointed out that in terms of the spot market, most provinces in China have a small price difference between peak and valley, and energy storage power stations can only utilize the midday low and evening peak for one charge and discharge. In terms of capacity leasing, there are also issues such as short leasing cycles, large price fluctuations, and actual leasing prices declining year by year. Policy subsidies also have instability. The phenomenon of bad money driving out good money is most severe in the domestic bidding market.

GGII research shows that the energy storage breakeven line is 700-800 yuan/MWh,but in 2023, the average price differences in various spot markets such as Mengxi, Shandong, Guangdong, and Gansu are all below the average line. This situation has not improved in 2024.

Overall, looking at the effective exploration models such as Jiangsu's peak summer response last year, it is difficult for energy storage profitability to fundamentally change nationwide in the short term.

Secondly,the heavy asset nature of lithium battery energy storage systems also determines the possibility of low-price sales.

If battery cells are not sold in a timely manner after production, their performance degrades quickly, and with high inventory costs, they must be cleared in a timely manner. Therefore, companies would rather sell at a loss than stop production. Some industry insiders bluntly state,that low prices have even become the default "contract" between buyers and sellers, which also fuels the price war.

It can be said thatlow-price competition has become a double-edged sword, causing varying degrees of harm to both the market and individual enterprises.While stimulating market demand, price wars will also accelerate market reshuffling. For those companies with weak technical strength and poor cost control capabilities, low-price competition will bring enormous survival pressure.

There are cases showing that some system integrators, in order to secure projects, have to adopt extreme measures such as compressing construction periods and offering low-price solutions, leading to low project development efficiency and even internal competition for orders.

In the short term, the order volume gives some companies a breather. However, in the long run, these companies will face the risk of being "cleared out."

In addition, Chinese companies are fleeing overseas to avoid domestic competition, but overseas is not a safe haven. The overseas market differs from the domestic one in that it implements a lifelong accountability system for the entire product lifecycle lasting 15 or even 20 years, with extremely high retrospective risk costs. Small and medium-sized enterprises lacking experience will inevitably pay high tuition fees for this. Even Sungrow Power Supply faced high penalties in overseas markets early on due to the pandemic.

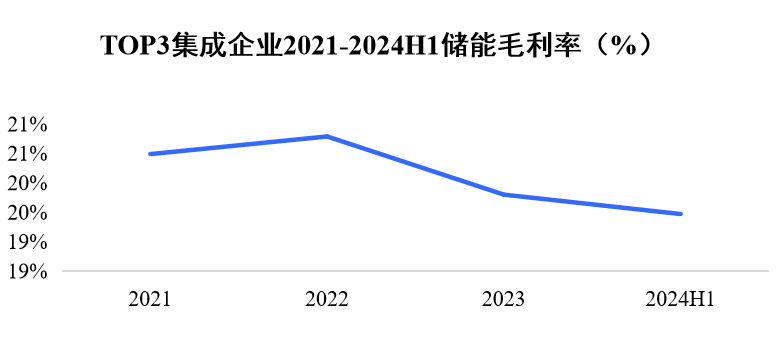

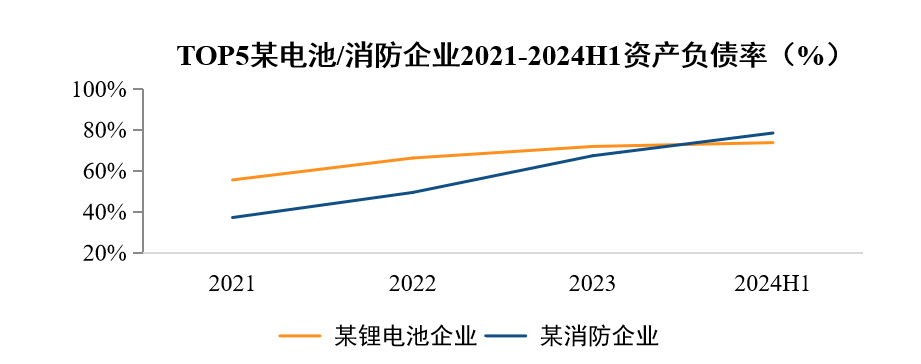

Overall, under irrational price competition, long payment terms and low prices not only make cash flow difficult for small and medium-sized enterprises,but also due to the long industrial chain, high R&D investment, and long capital occupation time in the integrator/cell segment, even some top 10 companies face issues of bad debts and high liabilities.

Intense competition among the top 10.

In the midst of competition, the competitiveness of the energy storage industry has undergone new changes. Although the top ten players have basically been established, new markets, new products, and new business models will become the next breakthrough for enterprises.

GGII predicts that competition among the top ten companies will intensify before 2025,and aside from the leading companies having certain advantages, the market share of the second and third tier companies will still have some variability.

On one hand,owners are raising the threshold requirements for procurement by central state-owned enterprises to change this "price-only" driven energy storage "behemoth."

The bidding documents publicly released for bidding in 2024 show that the vast majority of projects require equipment suppliers to provide a warranty and operation and maintenance services for major equipment, such as batteries, energy storage systems, and PCS systems, for a period of 3-5 years, with the 5-year warranty requirement significantly higher than in 2023.

In addition, the equipment has begun to show demands for long-cycle maintenance in overseas markets. For example, the China Electric Power Construction Corporation's 2025-2026 centralized procurement of energy storage equipment requires bidders to undertake maintenance and repair work for the supplied equipment over a 20-year operational period, including all equipment maintenance, repair, and battery replacement during the operational period.

Moreover, tiered batteries or factory stock batteries are basically unable to circulate in the large-scale bidding market. For instance, the China Electric Power Construction Corporation's 2025-2026 centralized procurement of energy storage equipment requires that the battery production date must not be more than 3 months earlier than the actual supply date of the project; China General Nuclear Power Group has initiated the 2025 annual framework procurement for energy storage systems, not accepting stock batteries with a production date greater than 90 days, nor accepting tiered utilization batteries.

The joint bidding that was quite popular in 2023 has also basically collapsed. According to relevant statistics, about 51.4% of the 35 projects in 2024 do not accept joint bids. The strong alliances in 2024 are more reflected in resource replacement rather than securing contracts.

On the other hand, there is still great uncertainty in overseas markets,For example, both the European and Middle Eastern markets have shown strong characteristics of "resource replacement."

At the same time, overseas giants are continuously forming strong competitive relationships with Chinese companies. In the fourth quarter of 2024, Tesla deployed a 11 GWh energy storage system, setting a record for the highest installed capacity in a single quarter. In 2024, Tesla's energy storage deployment reached 31.4 GWh, a 100% increase compared to the 15.7 GWh deployment for the entire year of 2023, creating a new record.Tesla's "fierce offensive" has also brought greater impact to more Chinese giants going overseas.

In 2025, the reshuffling of energy storage is still accelerating.For individual enterprises, 2025 is not only a year of significant opportunities but also a year of major tests.

Source: Gaogong Energy Storage

undefined