11

2025

-

02

Energy storage cells shipped over 320GWh throughout the year: changes in three major sub-markets.

Author:

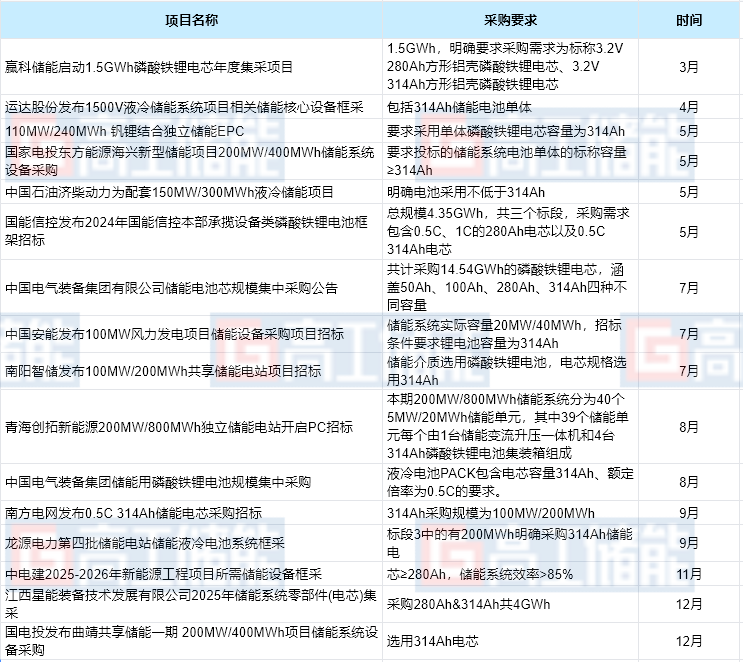

Looking back at the energy storage bidding market in 2024, cell centralized procurement, as an important subset, is usually accompanied by centralized procurement and framework procurement models.

Looking back at the energy storage bidding market in 2024, cell centralized procurement, as an important subset, is usually accompanied by centralized procurement and framework procurement models.

On one hand, cell centralized procurement/framework procurement can reduce procurement costs for owners, improve efficiency, and ensure the stability of the supply chain. The centralized and framework procurement models help increase market concentration, making it easier for large enterprises to capture market share.

On the other hand, the cost optimization brought by the large-scale production of 314Ah cells in 2024 has accelerated the replacement process of 280Ah cells and raised higher technical requirements.

In this regard, Gaogong Energy Storage observes from multiple aspects such as procurement ratio, technical requirements, quality requirements, and certification requirements,in order to more intuitively demonstrate the changes in procurement demand for energy storage cells in 2024.Firstly, the procurement ratio and procurement entities of 280Ah and 314Ah energy storage cells are changing.

From the procurement ratio of energy storage cells in the first half of this year, 280Ah energy storage cells are still mainstream. As major battery manufacturers accelerate production in the second quarter, 314Ah energy storage cells are being released in volume,

and owners are also starting large-scale procurement of 314Ah energy storage cells in the second half of the year.From the procurement ratio perspective,

the two major state-owned enterprises, State Power Investment Corporation and China Electrical Equipment Group, have each exceeded 70% in the single bid share of 314Ah cells in the GWh-level centralized procurement initiated this year.Moreover, the single bid section of China Energy Storage Equipment Group even reached the 11.1GWh level, marking the first breakthrough of 10GWh-level procurement for 314Ah energy storage cells this year.

From the perspective of bidding entities,

the company that first released the procurement signal for 314Ah energy storage cells this year is China Electrical Equipment, followed by other state-owned enterprises and integrators starting to follow up. According to incomplete statistics from Gaogong Energy Storage,the bidding for 314Ah energy storage cells with clear procurement in 2024 has exceeded 20GWh.From an industry perspective, the five major and six minor players have always been the absolute main force in the energy storage bidding market. Their procurement standards represent certain industry technical standards and current demands, and they are often the first group in the energy storage market to bravely "eat crabs," boosting the confidence of integrators in supporting 314Ah energy storage cells.

Secondly, the thresholds for performance requirements and quality requirements are rising.

In terms of performance requirements,

the bidding for energy storage in 2024 requires the cycle life of 280Ah and 314Ah cells to exceed 6000 times, with a calendar life of no less than 15 years, and energy efficiency requirements are also increasing.It is worth mentioning that the newly issued "GB/T 36276-2023 Lithium-ion Batteries for Power Energy Storage" requires the efficiency of cell units to be no less than 93% at an ambient temperature of 25°C, while the initial charge and discharge energy efficiency of battery modules and battery clusters should be no less than 94% and 95%, respectively.

From the system level perspective, the "GB/T 44026-2024 Technical Specifications for Prefabricated Cabin Lithium-ion Battery Energy Storage Systems" requires that under normal temperature conditions (25°C), the charge and discharge energy efficiency of the DC cabin should be no less than 88%, and that of the AC cabin should be no less than 83%.

Under the new national standards, cell manufacturers are also widely discussing the balance between economic benefits and safety thresholds.

Similarly, Haopeng Energy Storage, which achieved mass production of 314Ah cells in 2024, stated that for some market demand cells at 0.5P, energy efficiency needs to be improved to over 94.5% to enhance economic returns. This trend prompts cell manufacturers to pay more attention to economic benefits, potentially neglecting the safety performance of the cells.

Moreover, Haopeng believes that under the winding process, increasing the energy efficiency of 314Ah cells from 94% to over 94.5% will lead to an increase in the maximum temperature of the cells during overcharging and thermal runaway by 30°C to 50°C, significantly increasing the safety design costs to prevent thermal runaway and fire.However, as the market is applied more deeply, Haopeng believes that the market will tend to enhance the safety thresholds of cells.

At the same time, with the implementation of the GB36276-2023 standard, the requirements for external short circuits have become stricter, ensuring the absolute safety of cells under external short circuit conditions.

Therefore,

Haopeng stated that in the future, the structural design of 314Ah cells needs to consider overcurrent design more precisely,

maximizing the reduction of the impact on charge and discharge energy efficiency while ensuring safety.In addition, some owners have also initiated bidding demands for power-type energy storage systems and cells.Power-type products are mainly used in scenarios such as grid frequency regulation, load smoothing, energy recovery, and voltage sag management. With the continuous increase in the proportion of renewable energy grid connection and power market reform, the demand for rate-type energy storage products is very clear.

On January 17, the Southern Power Grid Energy Storage Company announced the winners of the 2023-2024 energy storage station equipment framework procurement project. This bid included a demand for 1P battery energy storage system framework procurement, won by Zhiguang Energy Storage.From an industry perspective,

this procurement is also the first time that a 1P energy storage battery system requirement has appeared in power centralized procurement.

(There was also the concept of 1C energy storage batteries before).In April, Huadian Group released a tender announcement for the procurement of lithium iron phosphate electrochemical energy storage systems for the Jiangxi Huadian Yifeng Shuangfeng Huanggang Wind Power Project, with a bidding scope of 15MW/15MWh lithium iron phosphate electrochemical energy storage systems, with a battery charge and discharge rate of 1C, and a nominal capacity of battery units ≥280Ah.On November 28, the tender announcement for the 2025 annual cell framework bidding was released by China Storage Technology, with the content of package 2 procurement being 1C for 1GWh of cells for the year 2025.In terms of quality requirements,

some state-owned enterprises have begun to clarify requirements for battery production dates,

which to some extent prevents the circulation of expired batteries and stock batteries in the market.

In the tender announcement for energy storage systems for the 2025-2026 fiscal year released by China Electric Power Construction,,已有央国企开始明确对电池生产日期的要求,一定程度上预防了过期电池、库存电池在市场上的流通。

中电建发布的2025-2026年度储能系统招标公告中,The battery production date must not be earlier than three months before the actual supply date of the project.The performance and parameters of the battery (cell) should comply with the national quality standards currently in effect during the project implementation phase.

According to data from GGII, China's planned lithium battery production capacity in 2024 is about 590GWh, a decrease of nearly 60% compared to 2023. Under the supply-demand imbalance, cell manufacturers are more cautious about production.

From the production rhythm of cell manufacturers, a three-month production to supply time restricts companies from fulfilling contracts with inventory cells; on the other hand, it also filters out companies that have certain scale mass production capabilities in a short time.

Thirdly, there is a demand for overseas certification in the procurement of energy storage cells.

In a procurement close to the end of the year, there was a clear requirement for overseas certification of 314Ah energy storage cells.

On December 24, a bidding announcement for the centralized procurement project of energy storage system components (cells) in 2025 was released by Jiangxi Xingneng Equipment Technology Development Co., Ltd., which is controlled by Zhejiang Yaoning Technology Group, with a total procurement of 4GWh of 280Ah and 314Ah cells.

The bidding requirements also stated that cells certified by IEC62619, UL1973, UL9540A, and UN38.3 would be given priority.

It is worth mentioning that IEC, UL, and UN are all overseas certification requirements and are key indicators, but cell manufacturers face the pain point of long certification times.

Among them, the North American UL certification cycle is 8-16 working weeks, and the European CE is 3-6 working weeks, both of which are core safety certifications for overseas markets. In addition, energy storage cells also need to pass other certification reviews such as lithium battery UN38.3 and transportation identification, which further extends the overseas timeline.

In 2024, in addition to cell manufacturers obtaining orders from overseas integrators, domestic system integrators are also exploring overseas possibilities, which is driving continuous changes in domestic cell procurement requirements.

According to incomplete statistics from GGII, as of the end of October, there have been over 52GWh of energy storage battery overseas orders. Leading battery companies such as CATL, Hicharge Energy, Ruipu Lanjun, EVE Energy, Chuangneng New Energy, and Guoxuan High-Tech have all secured overseas orders.

According to incomplete statistics from GGII, this year, the following bids have proposed procurement demands for ≥280Ah and 314Ah energy storage cells:

(For incomplete statistics*)

Source: GGII

undefined